Recent Articles

The picture is an Amazon Associate link - Check Price

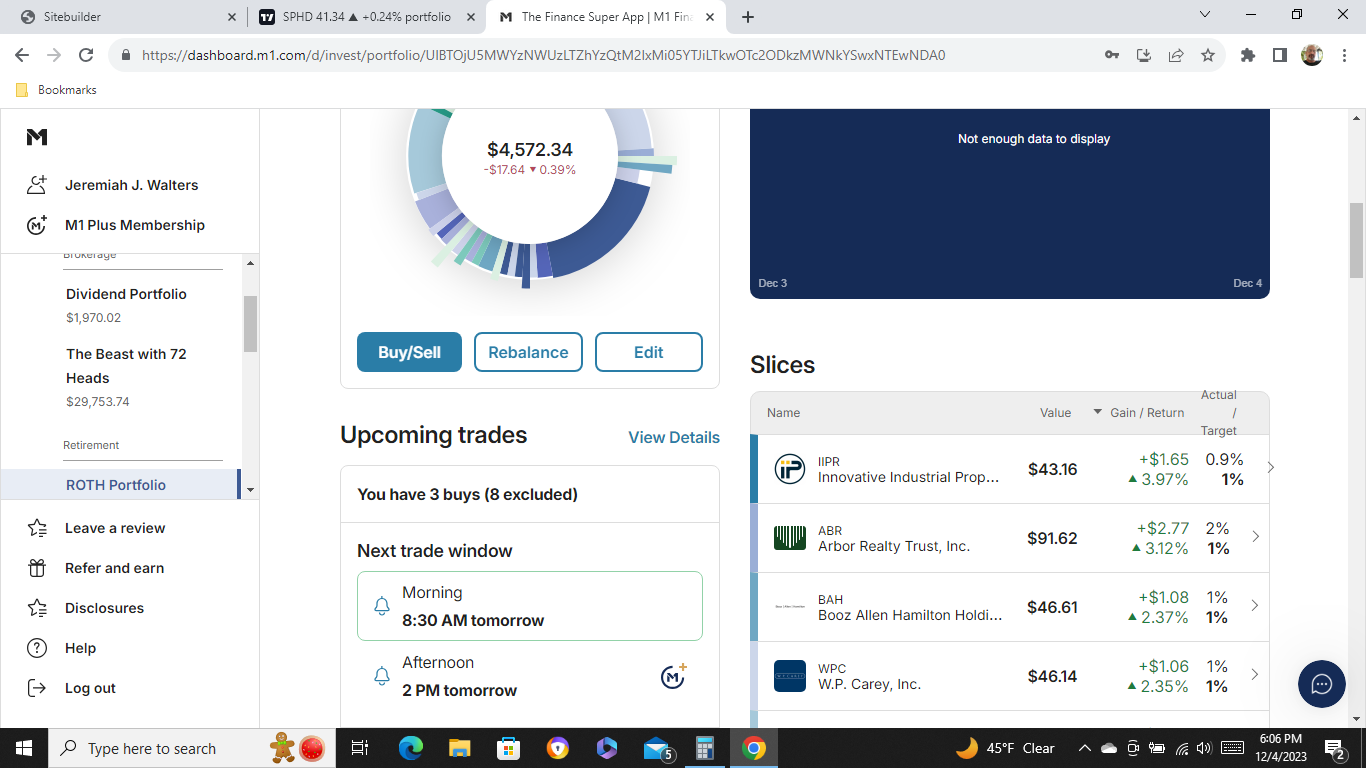

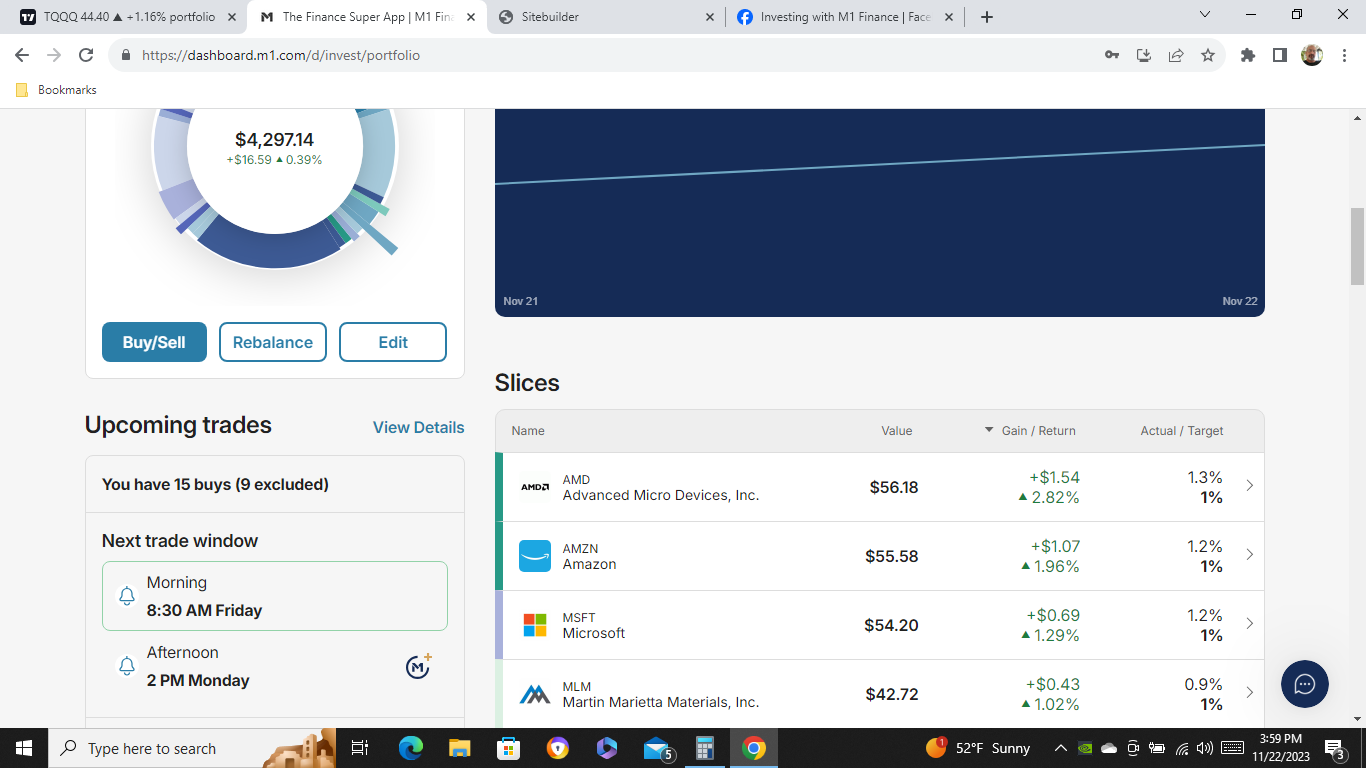

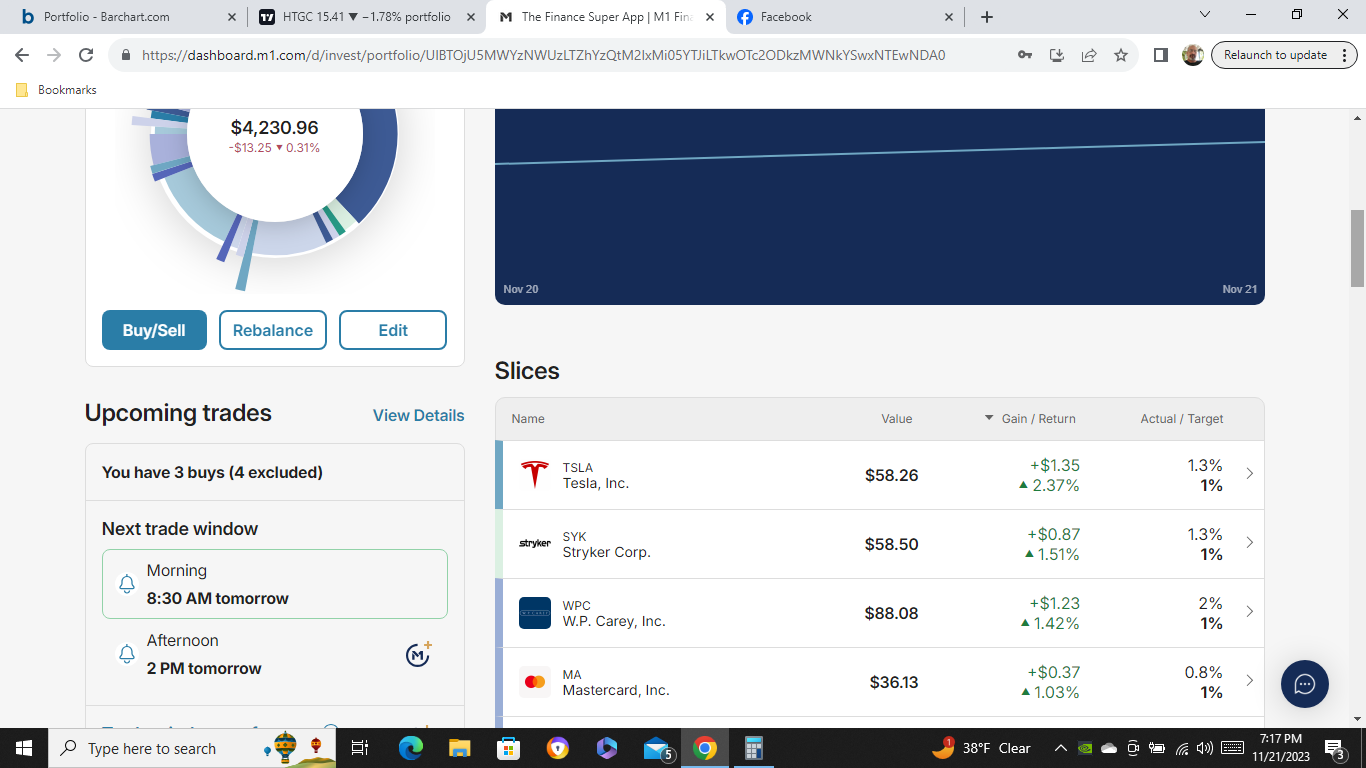

12/19/2023 Total Returns - ROTH Activity

12/19/2023ROTH Account - Buys

12/7/2023 "Ka Boom!" AMD up 6.2% This Week - ROTH Activity12/7/2023 ROTH Activity

Timeless lessons on wealth, greed, and happiness Paperback – September 8, 2020

As an Amazon Associate I earn from qualifying purchases. I am not the seller of these products. I encourage people to find the best price on Amazon.

Tradingview

Tradingview

Barchart

1/15/2024 Current Balance

Click the link to see the 54 holdings within the stock/etf portfolio, asset allocations, dividend yield, expense ratio, and performance.

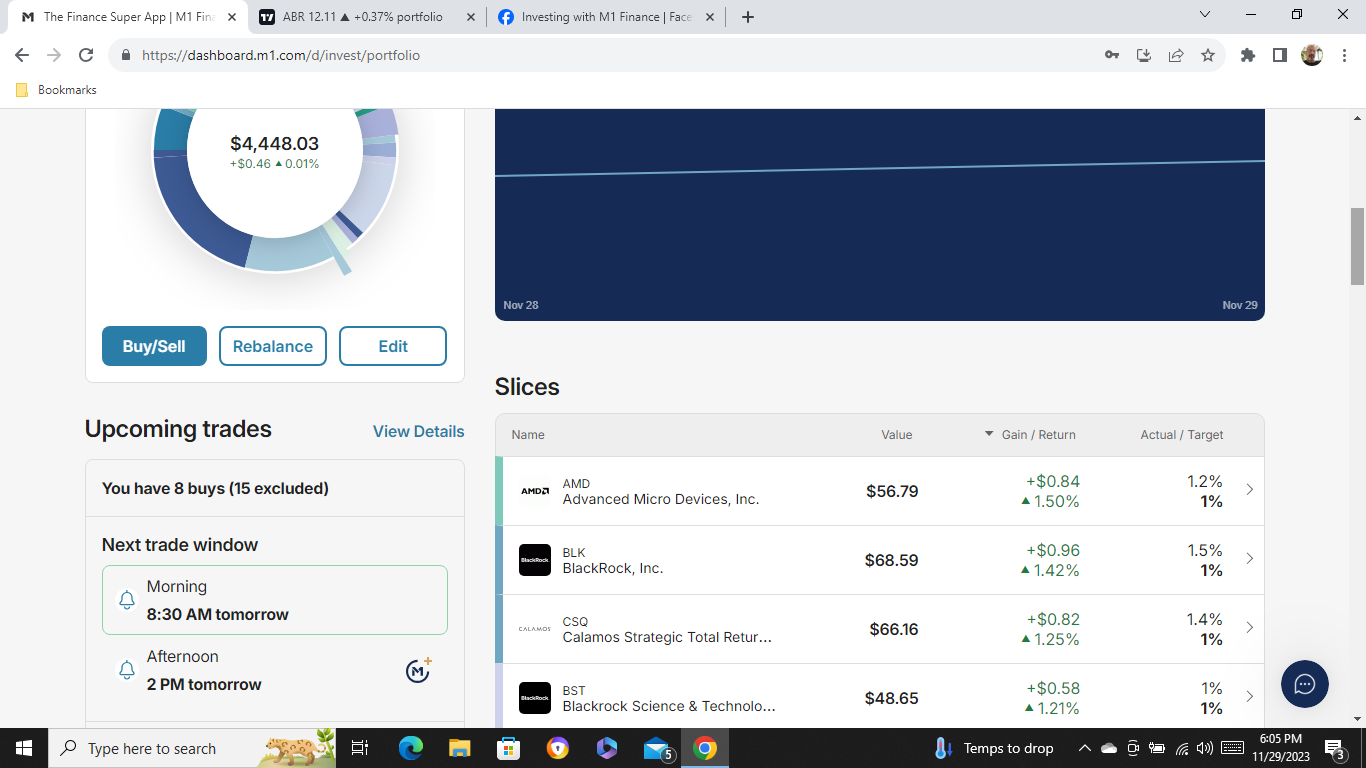

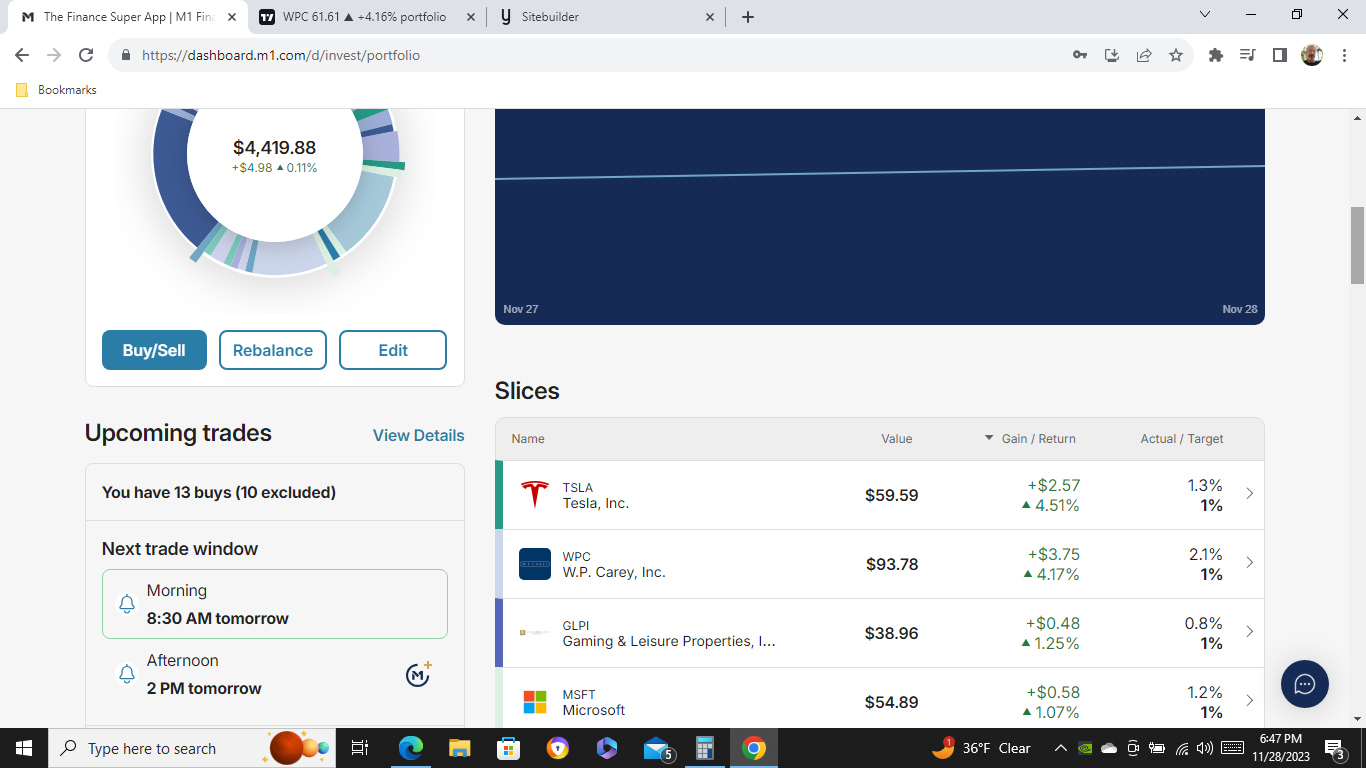

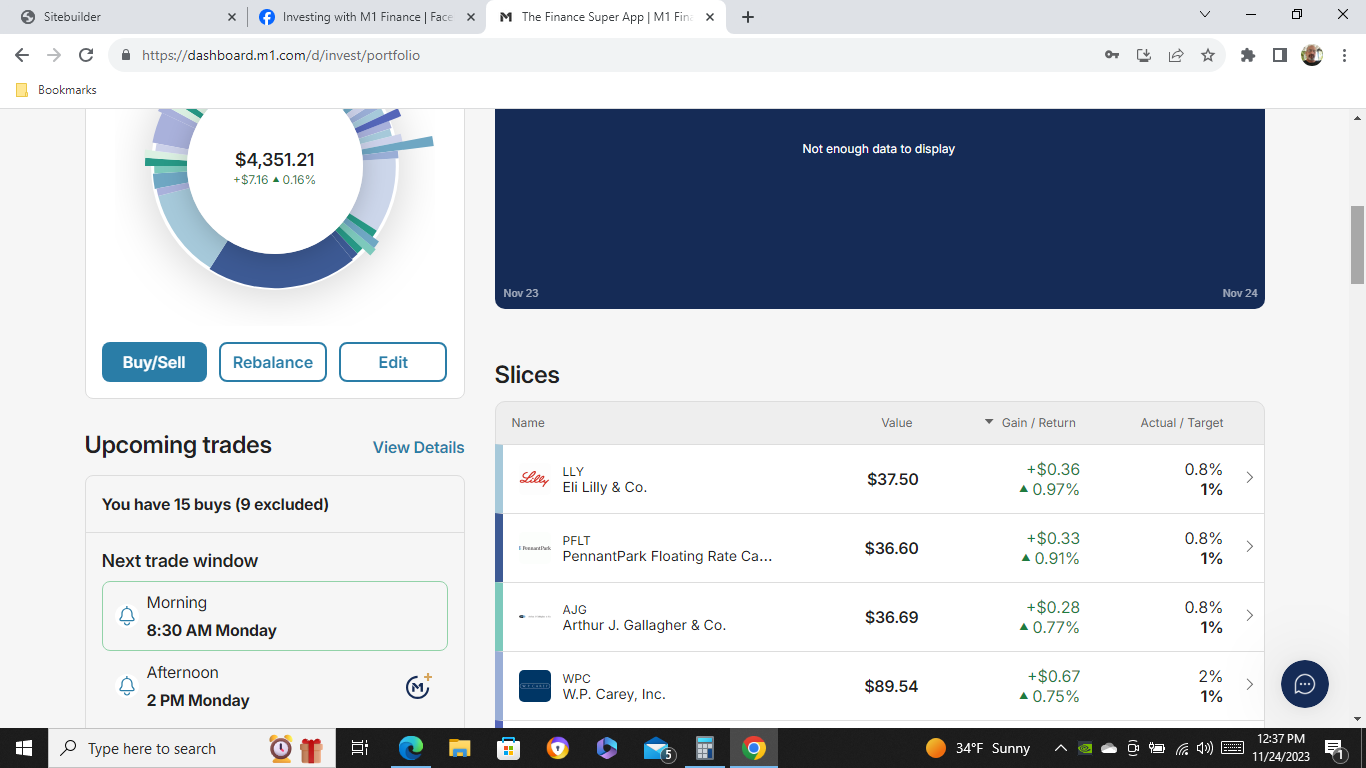

An investor using M1 Finance can create a portfolio/pie and see what the returns could be based on past performance before investing.

1/15/2024 Current Balance

"The Beast with 71 Heads" Click the link to see the 71 holdings within the taxable stock/etf portfolio, asset allocations, dividend yield, expense ratio, and performance.

Chicago City Skyline Abstract Watercolor Gray and White Unframed set of 2 Wall Art Poster, Stock Market Decor, Day Trader Decor Gift, Stock Broker Office Decor

As an Amazon Associate, I earn from qualifying purchases. If you buy anything, including items not for sale in the store, then I earn a small commission. I am not the seller of items in my store.

Investing in physical silver and gold is a good idea. I am an Amazon Associate, so I am required to say, "I earn from qualifying purchases". If you buy anything, including items not for sale in the store, then I earn a small commission. I am not the seller of this item.