Recent Articles

The picture is an Amazon Associate product link - Check Price

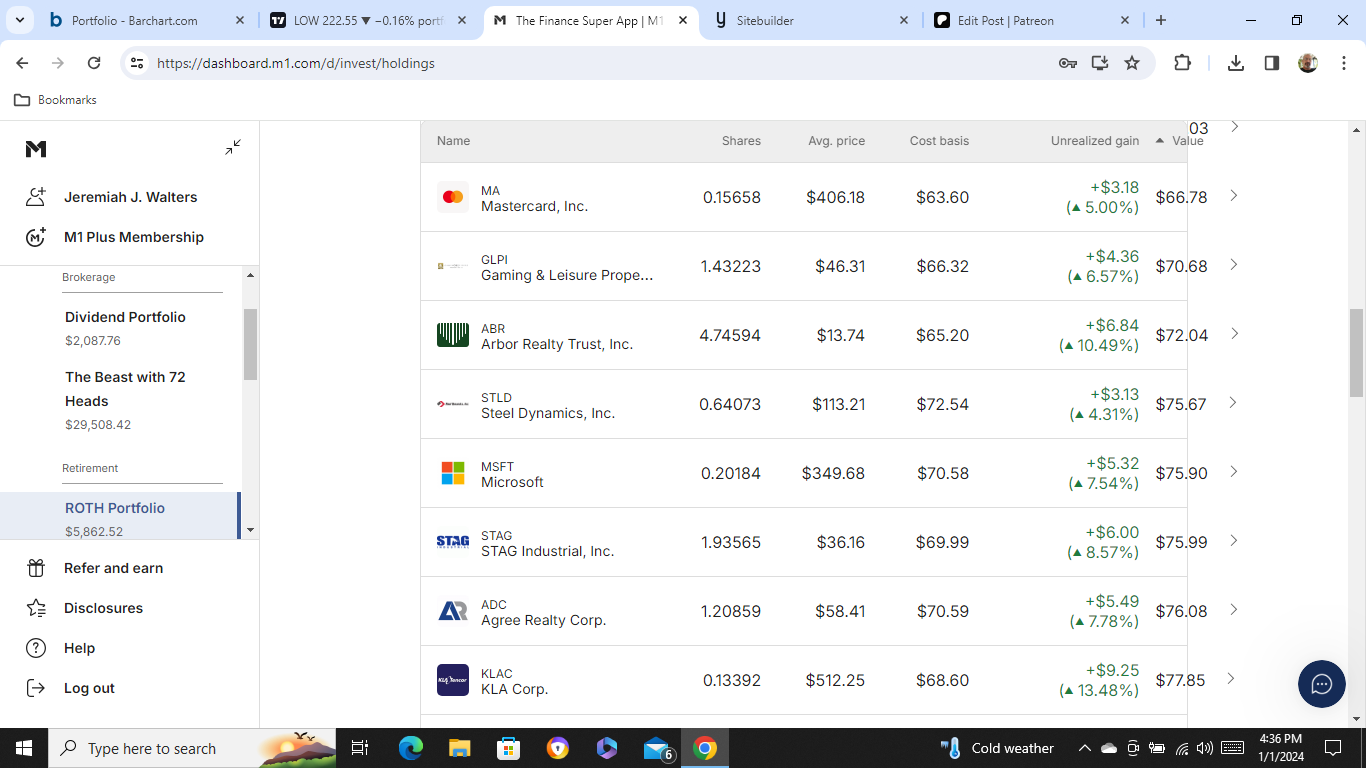

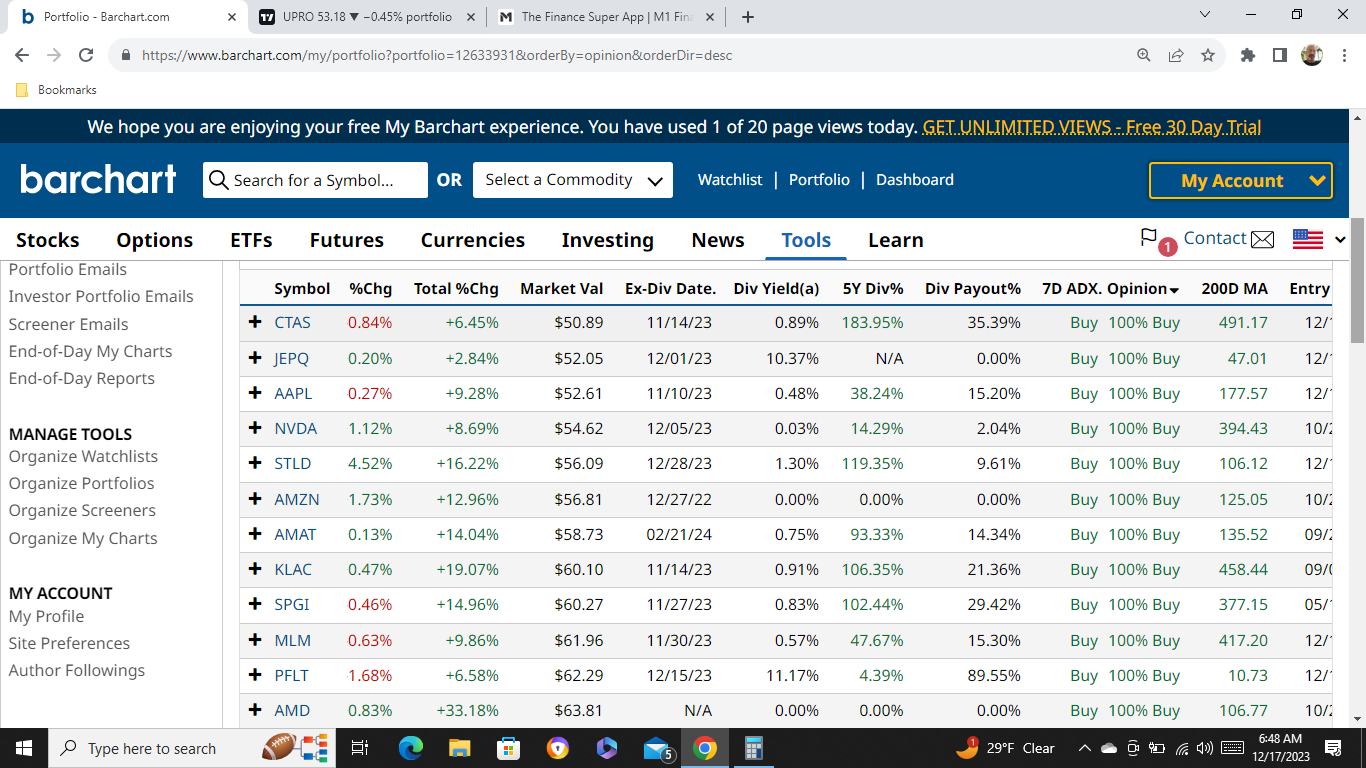

1/1/2024 1% to 2% Allocation Changes - My Strategies

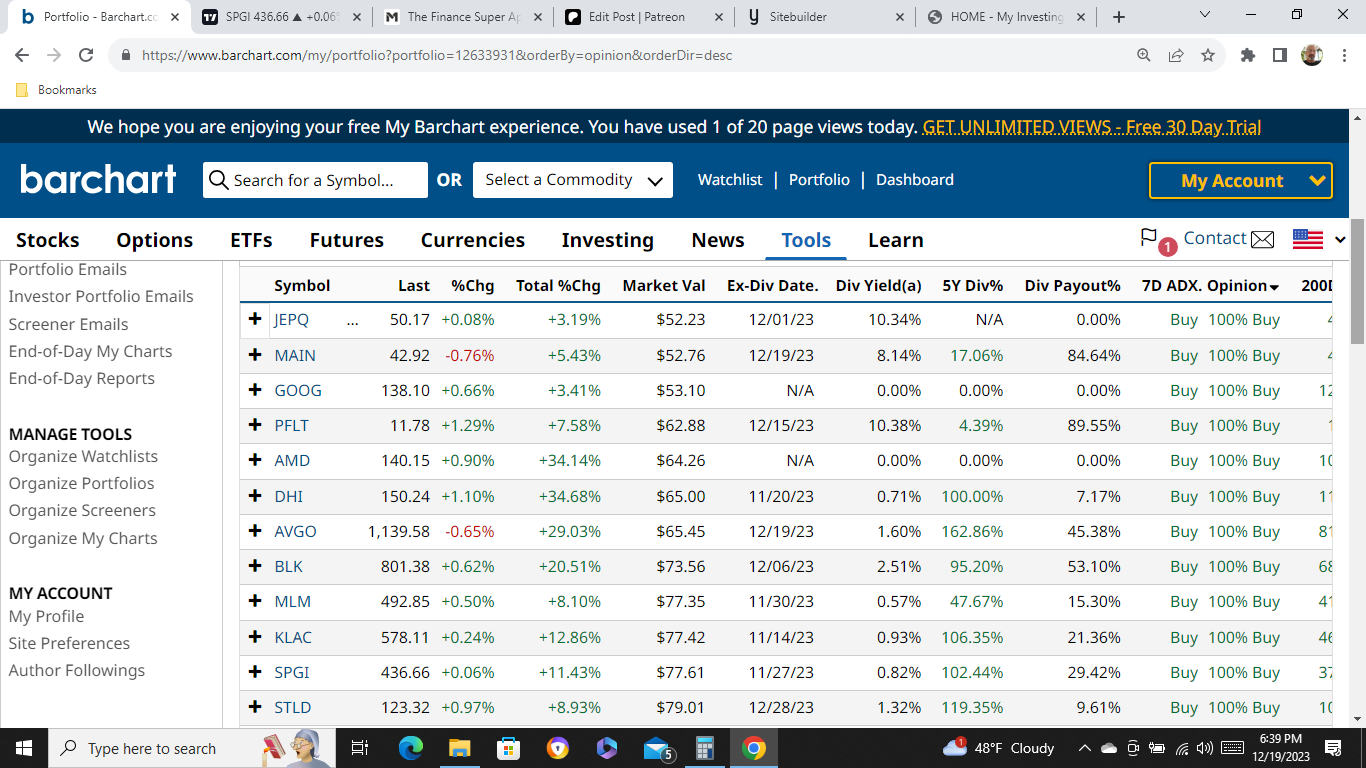

12/19/2023 100% Buy Opinions - My Strategies12/18/2023 25% Cash and/or Bonds/CDs - My Strategies12/17/2023 ROTH Investing - My Strategies

12/11/2023 Average UP!!! - My Strategies