Recent Articles

The picture is an Amazon Associate link - Check Price

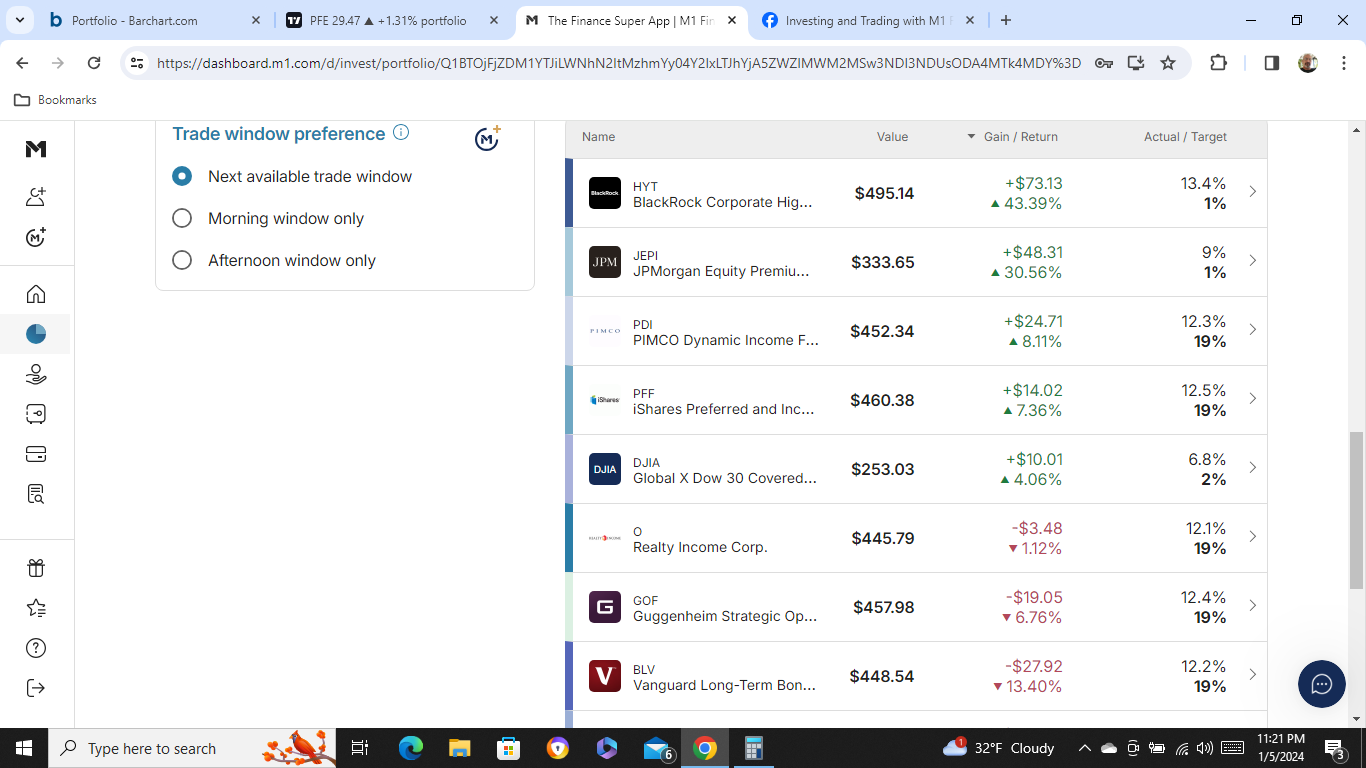

1/6/2024 A New Pie - Taxable Account Activity

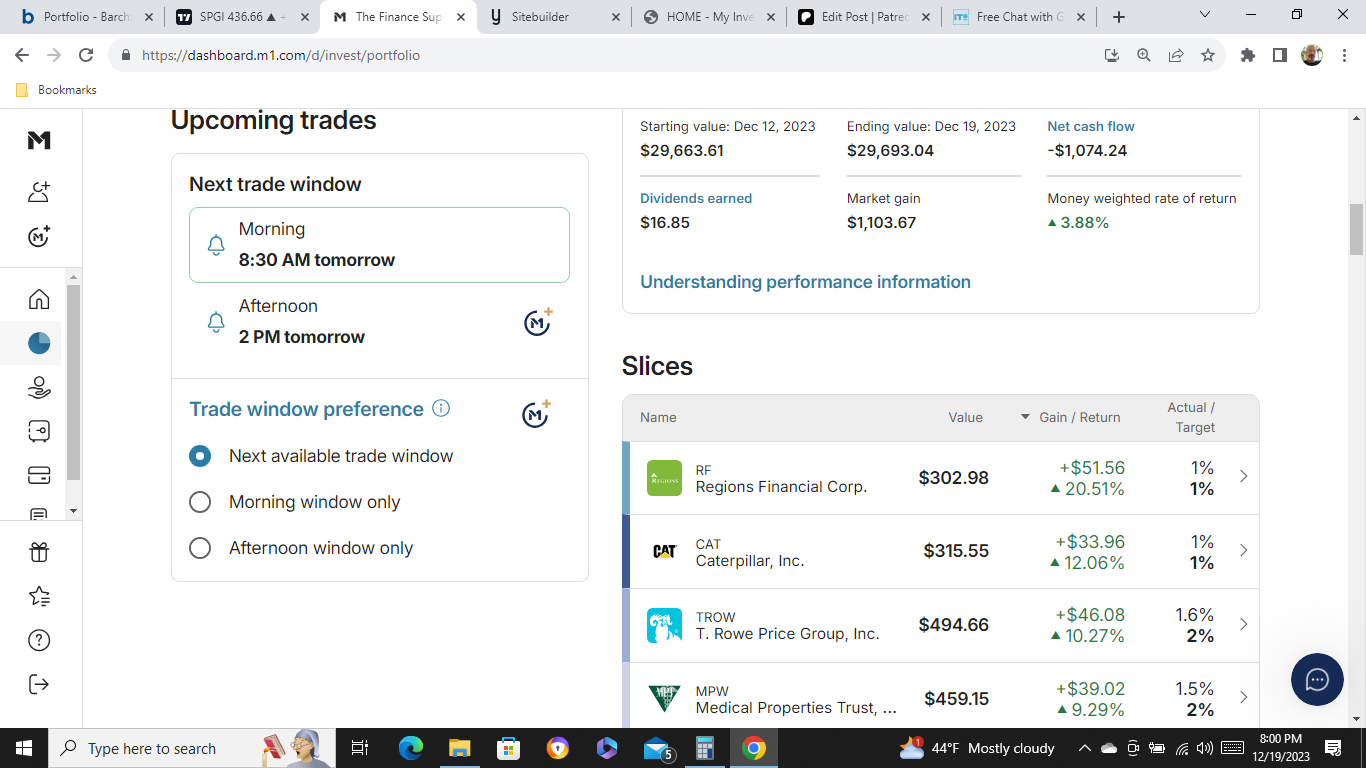

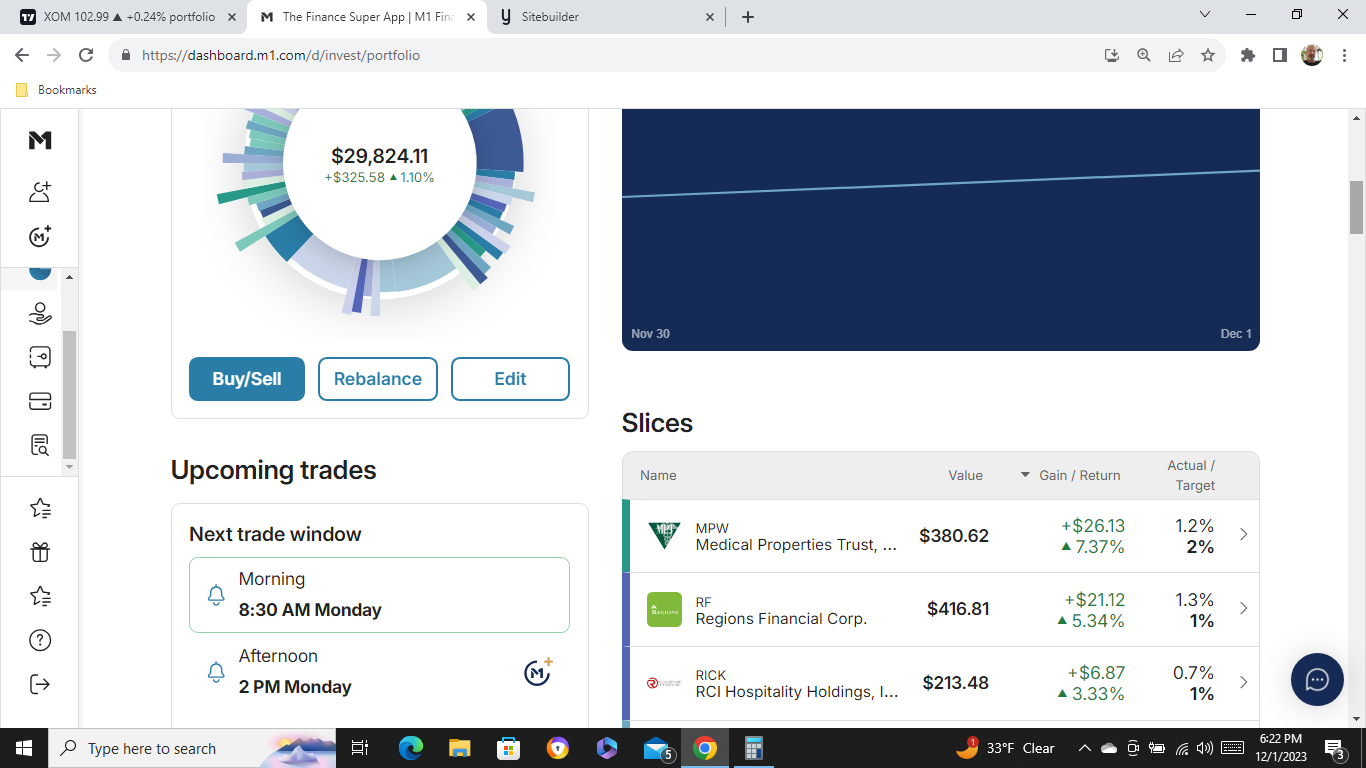

12/10/2023 Best Holdings in the Last 5 Trading Days - Taxable Account Activity

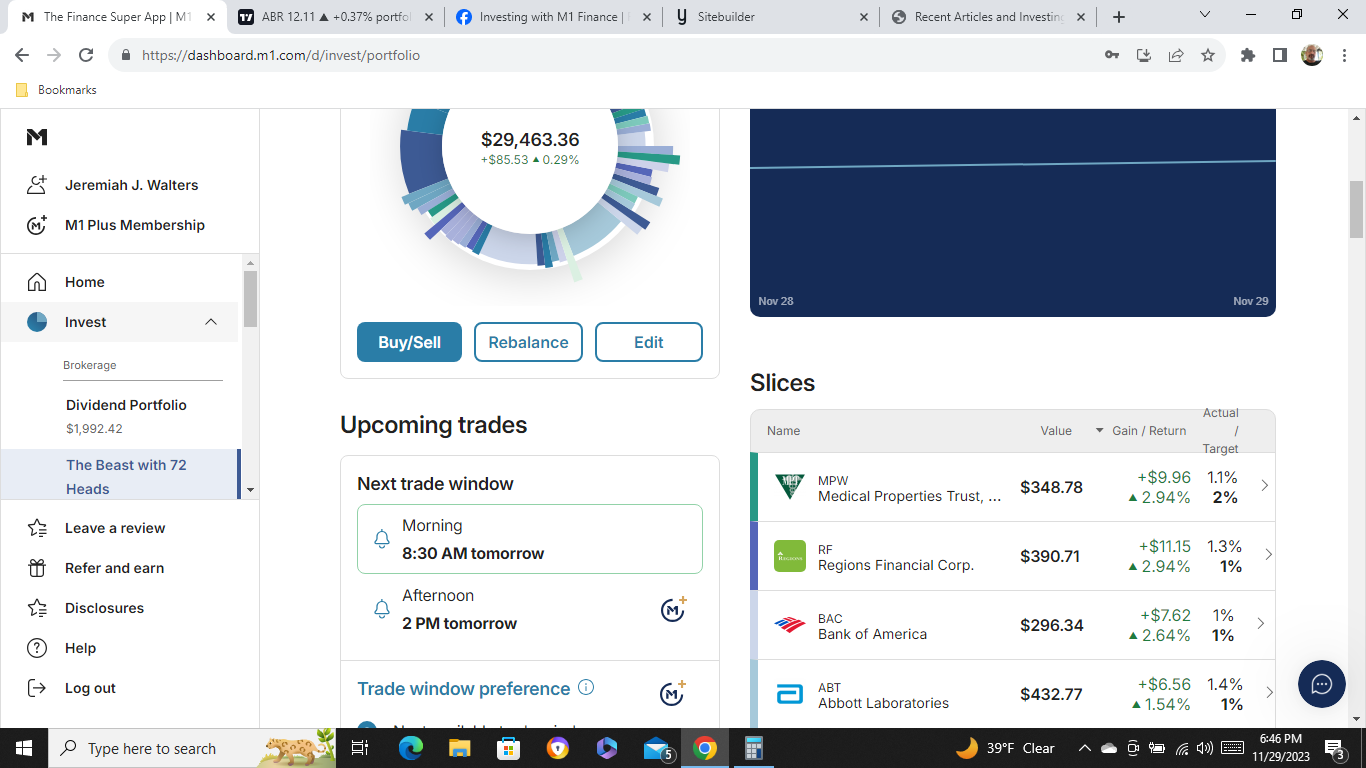

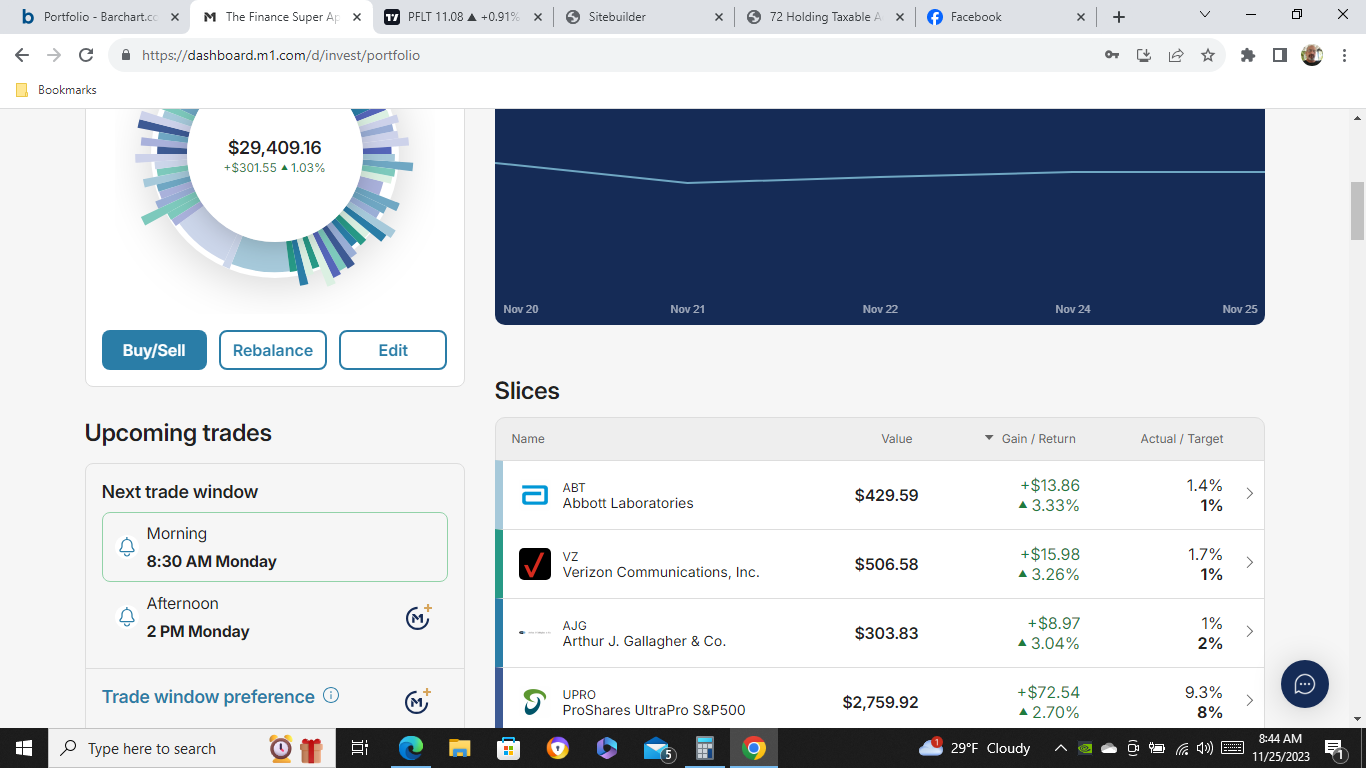

12/10/2023 72 Holding Taxable Account

Grow Your Investment Portfolio Like A Pro Using Financial Statements and Ratios of Any Business with Zero Investing Experience Required Paperback – August 17, 2022 by A.Z Penn (Author)

As an Amazon Associate I earn from qualifying purchases. I am not the seller of these products. I encourage people to find the best price on Amazon.

1/15/2024 Current Balance

Click the link to see the 54 holdings within the stock/etf portfolio, asset allocations, dividend yield, expense ratio, and performance.

An investor using M1 Finance can create a portfolio/pie and see what the returns could be based on past performance before investing.

1/15/2024 Current Balance

"The Beast with 71 Heads" Click the link to see the 71 holdings within the taxable stock/etf portfolio, asset allocations, dividend yield, expense ratio, and performance.

Success Motivational Poster Quotes Wall Decor for Living Room Bedroom Office Bathroom Canvas Print sign Framed Art Decoration Ready to Hang

As an Amazon Associate, I earn from qualifying purchases. If you buy anything, including items not for sale in the store, then I earn a small commission. I am not the seller of items in my store.